August Home Values: Trends in the Australian Property Market

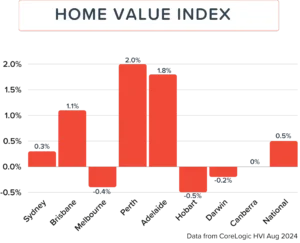

For the 18th month in a row, CoreLogic has reported a national increase in home values. The Home Value Index (HVI) rose 0.5%, identical to the growth in June. While homes are still growing in value, it’s worth noting that growth is starting to slow down, with three capital cities falling in home value.

What is the Home Value Index? [1]

The Home Value Index (HVI), also known as the Hedonic Home Value Index uses recent property sales across the country to report the trends of property growth nationwide. It’s a crucial metric for analysing the Australian residential property market.

City Specific Trends

Sydney

Sydney remains Australia’s most expensive capital city by a wide margin, at a median property value of $1,174,867. However, it only saw a growth of 0.3% over the last month, possibly indicating a plateau.

Brisbane’s property market continues to thrive, growing by 1.1%. It has now surpassed Canberra and Melbourne, positioning itself as Australia’s second-largest property market with a median property value of $873,987. This month also saw Queensland first home buyers provided a higher stamp duty concession threshold.

Melbourne

Melbourne experienced a median property value decline of -0.4%, bringing the median value to $781,949. Despite recent drops, the annual change in property prices shows a slight increase of 0.2%. For buyers, Melbourne’s listing numbers are above average, presenting more opportunities.

Perth

Perth’s 2% growth solidifies its place as Australia’s fastest-growing capital city [2]. With the median property value at $773,335 Perth continues to be a city with a growing population and tightening.

Adelaide

Adelaide follows closely behind Perth at 1.8%. Property values in Adelaide continue to grow, and at a median property value of $776,597, experts predict Adelaide may overtake Melbourne in the coming months [3].

Hobart

Hobart has seen the most significant downturn within the last month at -0.5%. Alongside Melbourne and Darwin, Hobart is one of the three capital cities to record a fall. Like Melbourne, Hobart has seen above-average listing numbers. CoreLogic’s executive research director Tim Lawless stated “weaker markets like Melbourne and Hobart are recording advertised supply well above average levels” (CoreLogic). The median property value currently sits at $646,863.

Darwin

Darwin has experienced a slight reduction, falling just -0.2% over the month and -0.3 over the quarter, the median property value is currently $507,097. It remains the cheapest property market of any capital city.

Canberra

Australia’s capital saw no notable change in its Home Value Index, maintaining a median property price of $870,910 (slightly up from last month’s $870,071, but not enough to change a percentile). Canberra is the third most expensive market among capital cities, however, it’s considered the most affordable capital city, alongside Darwin, when adjusted for local income.

[1] CoreLogic, 2024, Hedonic Home Value Index August

[2] Wright, Shane & McNeill, Heather, 2024 Hundreds of new arrivals a day make Perth the fastest-growing capital city WA Today.

[3] Kellner, Lydia 2024 Adelaide home prices could soon surpass Melbourne, PropTrack report reveals The Advertiser

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2024 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823