December Home Values: Trends in the Australian Property Market

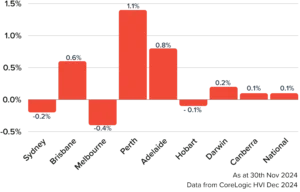

After a consistent year of home value rises, 2024 may see the final property value rise for some time, as the median home value rose just 0.1% nationally. We’ve known the property market was slowing for some time now, but the minuscule growth in December home values signifies a downturn in the property market in 2025.

What is the Home Value Index? [1]

The Home Value Index (HVI), also known as the Hedonic Home Value Index leverages recent property sales across the country to track property trends nationally. It serves as a key metric for analysing the performance of the Australian residential property market.

City Specific Trends

Sydney

After declining for the first-time last month, Sydney continued to report a drop in median property values, at -0.2%. The wind down in property value seems to be attributed to less buyer activity in the city. The median property value is now $1,196,809

Brisbane

Queensland’s capital city is effectively on track with its results from last month, with a steady 0.6% growth. Brisbane has maintained a level of consistency in regard to property growth, and its median property value now sits at $886,540. As all signs point to a market downturn, it remains to be seen if Brisbane can cross the coveted million-dollar mark before property values decline

Melbourne

For yet another month, Melbourne has reported a decline in property prices, with -0.4%. It could be construed that Melbourne provides an example of what will follow nationally, as it has been on the downturn for some time now. The median property value is now $776,949.

Perth

Perth stays in the race with Brisbane and Canberra for the third spot in terms of most expensive capital cities. Its growth of 1.1% is the largest amount of any capital city this month. The median property value is $808,090.

Adelaide

After rising by over 1% for 9 consecutive months. Adelaide finally dipped below the full percentile mark, with a growth of 0.8%. While it’s still reporting comparatively strong growth, the 0.8% growth supports the other signs of a slowing market.

Hobart

After a shocking 08% jump in value last month, Hobart once again saw a property decline in line with what it’s reported previously, at -0.1%. The median property price is $654,339

Darwin

Darwin continues to grow slightly, with a 0.2% rise in the median property value, its currently the cheapest capital city, with a median value of $496,860, and the only capital city still under $500,000.

Canberra

Canberra has had an ever-so-slight uptick in property values, at 0.1%, in line with the national median. This comes after two consecutive months of drops, and feels fittingly reflective of the national market, as we head into 2025 and election season. The median property value is $851,731.

Key Takeaways

The national median property price may still be rising, but just. Signs point to a decline shortly. This isn’t ideal for property owners looking to maximise their investment but could be promising for those looking to make 2025 the year they enter the property market.

Interestingly, lower pricing combined with the possible drop-in interest rates that is projected early next year could provide buyers with more borrowing power, which in turn could lead to more activity and higher prices later in 2025.

If you’re looking to buy, don’t wait until next year to start your journey. As soon as property prices drop nationwide, more buyers will emerge, heating up the market. Contact your local MoneyQuest broker and take the first steps towards homeownership today!

[1] CoreLogic, 2024, Hedonic Home Value Index December, 2nd December 2024. viewed 3rd December 2024

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823