Inflation and Interest Rates: How do They Impact Everyday Australians

If you’ve had your finger on the pulse of the finance industry recently, you’ve probably heard frequently about rising inflation and rising interest rates. While investors and economists are fluent in finance lingo, these terms can be confusing for everyday Australians. To most of us, high inflation and interest rates simply mean our day-to-day living is becoming more expensive.

However, inflation and interest rates serve two very different purposes. Inflation measures a change in cost of goods and services, Interest rates exist as a countermeasure to help reduce inflation.

What is Inflation?

Inflation is a measurement used to track the rising cost of goods and services in a country. For example, you purchased a litre of milk for $1.55. Today you go to the store and purchase a litre of milk from the same brand for $1.60. Inflation for that milk would be 3.2%.

While this is one example, government bodies, such as the Australian Bureau of Statistics (ABS) collect prices from national retailers, supermarkets and e-commerce sites to determine where consumer prices lie when compared to previous pricing. This forms the Consumer Price Index (CPI). When inflation is high, it typically means people are paying more for their everyday goods and services, and regulatory bodies take notice. When prices are down, this is called deflation.

What is Interest?

While inflation extends to all purchases, interest is applied to debts and savings. If you open a bank account with a deposit of $40,000 at 5% interest per annum, you will earn $2000 in interest over the year.

On the other hand, if you have a home loan at 5% interest, and your monthly principal repayment is $3,000, you will pay $150 in interest per month.

The Marshmallow Test

A good way to explain interest is the marshmallow test. The experiment was first performed by professors at Stanford University in 1970 to show the psychological factors of delayed gratification. Children were put in a room with a marshmallow in a room, and told they’d get an extra treat in 15 minutes if they didn’t eat the marshmallow.

While the marshmallow test was an experiment on human psychology, its also a simple way to explain interest. If you spend money immediately, you only receive the value of that money, however, if you place it in a savings account and wait, you can garner valuable interest.

Inflation and Interest: A Tug of War

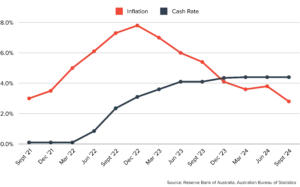

Rising interest rates are typically signs of high inflation, as interest is an effective way to combat inflation. Higher interest rates affect how much people looking for loans can borrow, reducing the activity in the market. This means fewer people borrow less money, and the economy can stabilise. With interest rates remaining high, the hope is that inflation will begin to reduce. For reference, The Reserve Bank of Australia (RBA) raised its cash rate in November 2023, inflation was at 5%. [1] (RBA, 2023).

What’s the Cash Rate?

The cash rate is the interest rate that the RBA charges banks to borrow funds, which affects the rates that the banks pass on to their customers. If you’ve read our Rate Reports, you may already be familiar with this term. By setting the cash rate, the RBA influences how much interest banks charge, impacting loan costs across Australia.

While high interest rates are meant to help stabilise the economy, they can put serious pressure on homeowners struggling to meet repayments [2] (Bettes, 2022). It’s worth considering whether interest rate rises hurt Australians more than they help the Australian economy.

What Other Factors Cause Inflation?

While consumer spending is a key driver of inflation, it’s not the only one. Environmental factors regularly affect significant shifts to inflation. The Covid-19 pandemic greatly impacted the economy, and some experts equate today’s inflation as the result of high government spending during the pandemic, and high levels of consumer spending as lockdowns ended [3] (Wright, 2024).

What’s Next?

Inflation is currently on the decline, and it’s anticipated that the cash rate will follow suit, possibly in December this year or early next year, however, we can’t say for certain. Inflation could always go back up, meaning high interest rates need to be implemented a while longer. If you want to keep up with the latest cash rate decisions, check our regular Rate Reports. And if you’re waiting for mortgage repayments to decrease, speak with our team today. We can help you explore refinancing options or set up a repayment plan that suits your budget.

If you have questions about interest rates, inflation, or managing your finances in today’s economy, reach out to your local MoneyQuest mortgage broker and finance specialist today.

[1] RBA. Statement on Monetary Policy – November 2023. 2023, Viewed 8th November 2024.

[2] Bettes, Kate. Up & Up: What does an interest rate rise mean for Australia? UNSW, 2024. Viewed 8th November 2024.

[3] Wright, Shane. Today’s inflation caused by yesterday’s COVID spending, The Sydney Morning Herald. 2024, Viewed 8th November 2024.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823