October Home Values: Trends in the Australian Property Market

October Home Values: Trends in the Australian Property Market

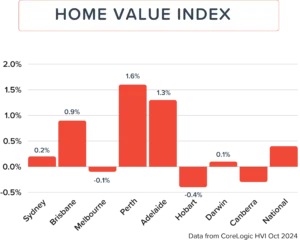

Heading into October, National Home Values continued their upward trend, however, growth is gradually slowing. House prices rose 0.4% nationally over the month, with the median value now standing at $807,110.

As we move through the middle of the spring season, the pace of growth is easing. This might encourage more investors to consider listing properties. However, high property prices and reduced borrowing capacity continue to challenge prospective homebuyers.

What is the Home Value Index? [1]

The Home Value Index (HVI), also known as the Hedonic Home Value Index leverages recent property sales across the country to track property trends nationally. It serves as a key metric for analysing the performance of the Australian residential property market.

City Specific Trends

Sydney

Sydney continues to lead in housing values, maintaining steady growth at 0.2%. While it’s the highest-valued housing market, it’s not the fastest growing. The median dwelling value is an impressive $1,188,912.

Brisbane

Brisbane experienced a healthy growth of 0.9% in October, albeit a slight decline from previous months. The median dwelling value now sits at $881,091, overtaking Canberra as the capital with the second-highest median value.

Melbourne

Melbourne experienced a slight decrease in average dwelling value, down 0.1%. After a year of slower growth than other capital cities[2], Melbourne may be on the path toward stabilisation. Investors and homeowners may be waiting for a rebound, as the median dwelling value is now $777,390

Perth

Perth remains Australia’s fastest growing capital, with a 1.6% growth rate. however, it’s showing signs of stabilisation. Perth’s average dwelling value is now $797,184, inching closer to Canberra in value.

Adelaide

Adelaide continues to have one of the healthiest growth rates of any capital city. Adelaide’s 1.3% increase in the month of September kept it just ahead of Perth in terms of median dwelling value at $802,075.

Hobart

Hobart continues its trend of declining property values, with a drop of 0.4% in October. The median dwelling value has fallen to $654,302, reflecting a broader decline in the region, which contrasts with national trends.

Darwin

Darwin saw a slight recovery with a 0.1% increase in median value, bringing it to $492,332. Despite previous declines, Darwin remains one of the most affordable capitals.

Canberra

Canberra recorded a 0.3% decline in property values since August, dropping to third place in terms of median dwelling value, which now stands at $844,882. Despite its high median price, Canberra remains relatively affordable when considering its strong median income.

Key Takeaways

The Australian property market in September showed signs of moderation, with national home values continuing to rise but at a slower pace. Perth leads in growth, while Sydney maintains its status as the highest-valued market. High prices and tighter borrowing conditions present challenges for new buyers, but opportunities exist for sellers in several cities.

CoreLogic also reports that housing remains “unaffordable across every metric”. Dwelling values are largely outpacing the median household income nationally, and it would take a household over a decade to save a 20% deposit for a median-value property. The stabilisation of the market is promising, as there may be some light at the end of the tunnel for homebuyers in the coming months, though it remains to be seen.

If you’re planning to buy a home, or struggling to meet repayments on your existing home, reach out to us. We may be able to help while home prices are high and guide you on the right path to homeownership. You can find your local MoneyQuest broker here.

[1] CoreLogic, 2024, Hedonic Home Value Index September

[2] Hannam, Peter, 2024, Melbourne is the only Australian capital to see a drop in house prices. What’s going on? The Guardian, published 3 August 2024, viewed 2nd October 2024

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2024 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823