Should You Buy Property in Australia 2022-2023?

If you clicked on this blog because you’re a first home buyer, property investor, or an owner-occupier trying to understand all the chaos in the Australian economy right now, we don’t blame you! It certainly seems complicated to say the least!

So, is it a good time to buy property in 2022-2023? Well, there isn’t a simple answer as it depends on your individual circumstances and whether you’re in the right place financially to be able to service a home loan. However, we hope the information below can help you decide.

What’s happening in the market right now?

Cash Rate increases – There is understandably a lot of fear in the market right now. With the RBA recently increasing the cash rate for the first time since November 2010, banks are passing the increase on to borrowers and people are worried they won’t be able to afford the extra repayments to cover the interest rate hikes, especially if they keep rising.

As of October 2022, the cash rate is sitting at 2.60% and experts at Australia’s major banks are predicting it to continue rising. The Commonwealth Bank, Westpac and NAB have stated that the cash rate may peak around 2.95 – 3.60 per cent by the end of the year.

It’s important to keep in mind that not only are interest rates expected to rise, there’s a possibility they will continue to rise until 2023. Buyers need to ensure they’re in a position where any future increases would not put them under financial pressure.

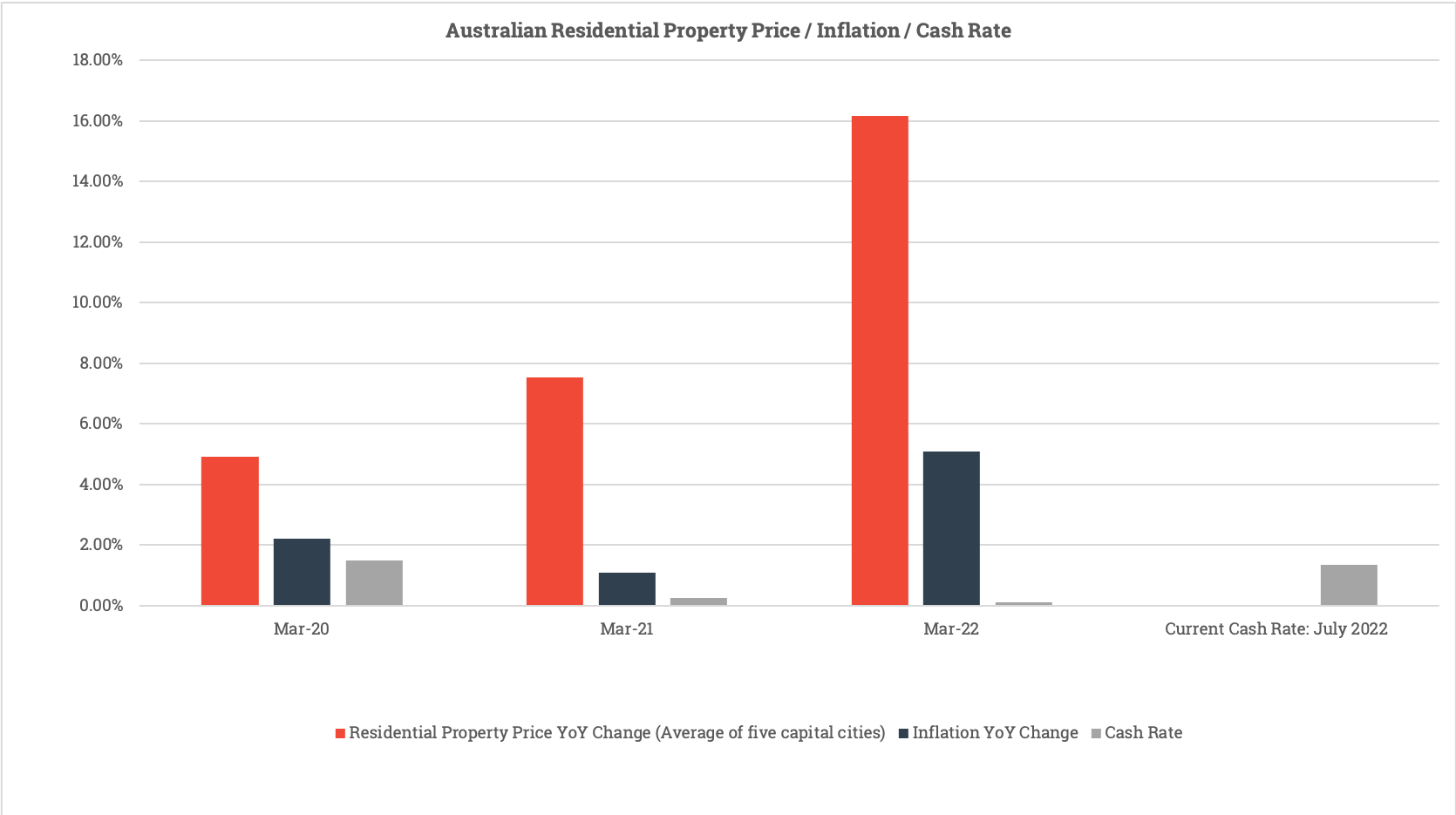

Housing price volatility – We have also seen rising property prices over the last 10 years, especially in the last 24 months (as seen in the chart below) as prices increased 16% from March 2021 to March 2022.

Source: Australian Bureau of Statistics (Total Value of Dwellings, Residential Property Price Indexes, Consumer Price Index)

Source: Australian Bureau of Statistics (Total Value of Dwellings, Residential Property Price Indexes, Consumer Price Index)

Economists at Australia’s major banks are predicting a 5% drop in house prices in 2022, expecting them to fall dramatically around 15% between April 2022 and December 2023. According to CoreLogic’s Home Value Index, we’ve already seen property value drop by 0.4% based on their 5 Capital City Aggregate in May 2022.

Borrowing power tightening – Additionally, some lenders are starting to reduce their debt-to-income ratio (DTI) in an effort to reduce the risk of more borrowers not being able to service their home loans. ANZ recently announced they will no longer take applications with a DTI of 7.5 or more. Further to this, ANZ decided to pause some lending to borrowers with less than a 20% deposit. NAB has also taken a similar stance, reducing their DTI limit from 9 to 8.

Considering all the key points mentioned above, it may not look like 2022 is a good year to buy or invest in property.

However, there may be some unique opportunities for Australians to purchase property in 2022, particularly for first home buyers. Here’s why.

Could 2022 be the right time to buy property?

High withdrawals and low sales – According to a recent report from CoreLogic, auction activity fell week on week across the combined capitals. Sydney saw its highest withdrawal rate since April 2020, with 28% of scheduled auctions withdrawn. So, what’s causing this drop?

There are many contributing factors, and one reason is home loans are becoming more expensive which means we are seeing fewer people attending auctions, causing less confidence for buyers and vendors in the market.

With all this uncertainty, now may be a good opportunity for first home buyers. There are less people to compete with at auctions, more vendors choosing to withdraw and consider selling their properties in other ways. This means there could be less competition for younger buyers to secure a property.

Further to this, there are government grants and schemes for first home buyers to help them enter the property market sooner. The most recent is the Help to Buy scheme, which came from the recently elected Albanese government.

By combining the uncertainty in the market and government schemes, first home buyers may just be in a sweet spot to secure a home loan and purchase their first property.

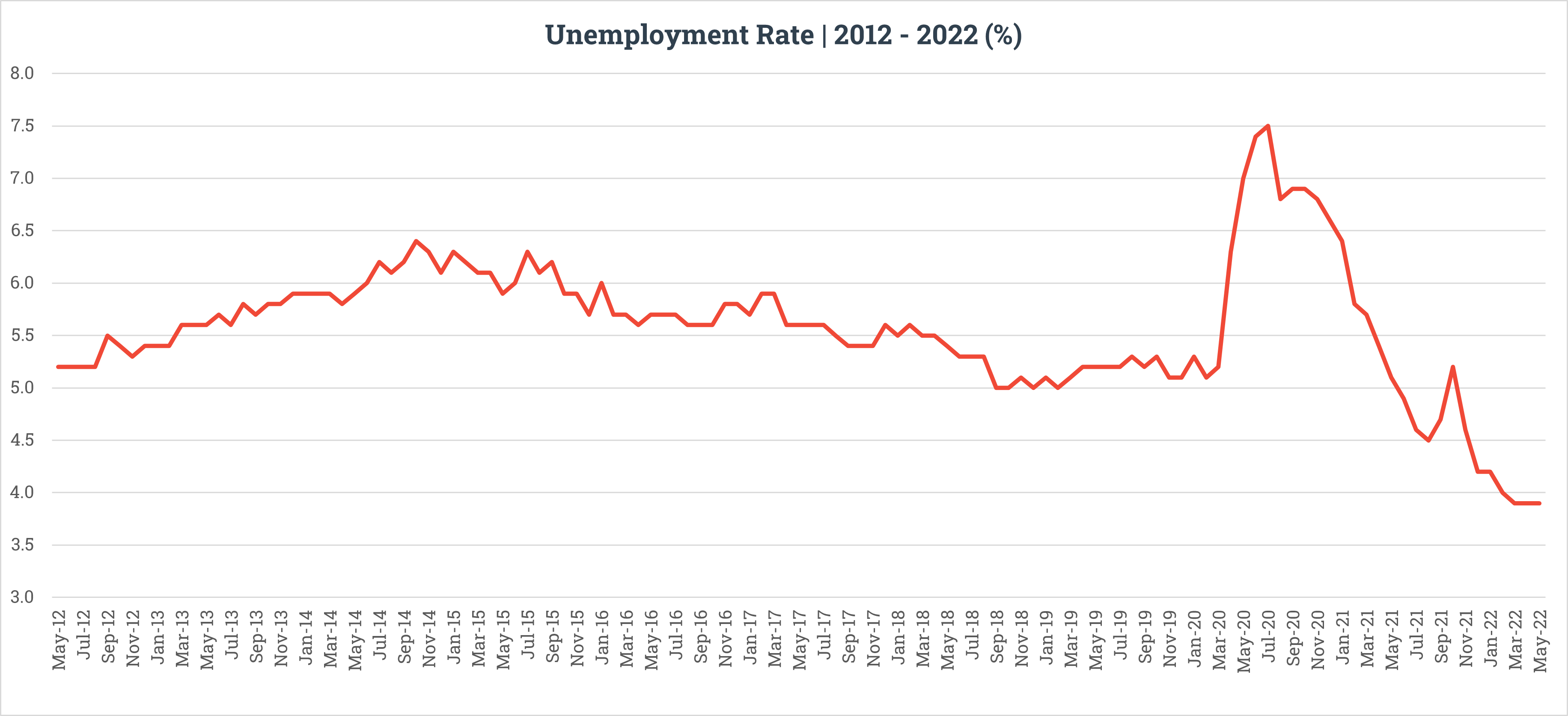

Record low unemployment rates – Although unemployment rates don’t have direct impact on property prices, they are connected. Generally, when unemployment rates rise, less people can afford to purchase properties or service their mortgages. This creates more supply, reducing prices. However, the impact of COVID-19 triggered some surprising moves in the Australian property market.

When COVID-19 settled in Australia and lockdowns were on the rise, unemployment across the country sharply rose as seen in the chart below. Property prices weren’t greatly affected, rather, prices began to explode over the coming months. Combining the fact that the RBA continued to keep the cash rate at an all-time low, made it cheaper and easier than ever before for buyers to borrow money. So how did this happen?

Source: Australian Bureau of Statistics (Unemployment Rate, seasonally adjusted)

Source: Australian Bureau of Statistics (Unemployment Rate, seasonally adjusted)

There’s plenty of factors causing this, one being that almost 40% of people who became underemployed during this period were aged between 15-25, according to the ABS. Considering the average age of first home buyers sits between 25-34, it’s not likely many of these individuals were in a financial position to service a home loan.

This means the majority of people looking to buy property during this time were already employed and unlikely to become unemployed. Adding record low cash rates to the equation, those with job security became more motivated to buy property.

But how does this make 2022 a good year to buy property in Australia?

Well, now that we know property prices may drop within the next 12 months or so, waiting until late 2022 could be a better time to enter the market. Since the world is also experiencing what’s known as the ‘Great Resignation’ (due to the impacts of COVID-19) and low unemployment rates, it’s now an easier time to secure that promotion or job, putting you in a better position to service a home loan. The best time to buy property might be 2022!

It’s also likely that the economy will not only recover, but strengthen, causing property prices to continue to rise over the longer term.

With so much uncertainty in the economy right now, making any large decision around property purchasing, refinancing or investing can be tough. However, it’s important to do your research and understand what’s right for you, before jumping in.

Our MoneyQuest finance specialists can help you by comparing your options, finding the right one for your circumstances. So, whether you are a first home buyer, investor or looking to refinance, click here to get in touch with us today!

This article does not provide financial advice. Consider all options available to you, seek professional guidance and only choose an option you are comfortable with.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823