The Hidden Costs of Buying a Home

Purchase price, deposit cost, interest repayments. There are plenty of costs of buying a home that you’re familiar with from the moment you start having the conversation. However, when you start crunching the numbers there are plenty of additional costs that savvy home buyers should account for. These costs cover everything from transferring the land title to ensuring it’s structurally sound and pest-free.

Stamp Duty

If you’re a first home buyer in Australia, good news! If you’re an Australian citizen or permanent resident purchasing your first owner-occupied home Victoria, Queensland, and New South Wales cover stamp duty to a certain property value, otherwise, you’ll be forced to eat the nasty cost.

It varies from state to state. For example, transfer duty for a new $500,000 property in Queensland would cost approximately $8,750 (as of 2024) however in the Northern Territory, stamp duty for a property of the same value would cost around $23,929; a substantial difference from its neighbours on the sunshine coast.

Stamp duty is effectively a tax charged by state and territory governments for specific documentation and transactions related to your home provided by the state, effectively the cost of your transfer being “stamped” and approved by the state or territory. It exists to build revenue for local state and territory governments, so they can fund projects in the public sector.

Establishment Fees

Often, when applying for a loan, lenders will charge an establishment fee (or application or upfront fee). This covers any administration tasks of processing your loan application. It’s a one-off fee and wildly differs depending on your circumstances. It regularly comes down to the value of your home and the type of loan product you apply for.

Conveyancing Fee

A Conveyancer is a legal representative who oversees the transfer of property (link to conveyancing blog). They draft the land and title transfer and account for any conditions regarding the property contract. The cost of a Conveyancer is, once again, dependent (that’s a bit of a pattern when it comes to property), but you can expect between $900 -$1,800 for their services.

Title Insurance

Title Insurance can legally protect you against any financial loss related to a property’s title. It is not required, but going without it can incur additional costs disputes and even loss of property during your homeownership. Title Insurance can grant peace of mind that you get what you paid for with your home. Determine whether Title Insurance is appropriate for you with a conveyancer or legal specialist. Title insurance cost varies, but is typically determined by the value, type and location of the property.

Transfer Fee

A transfer fee is the cost of transferring the land to you. In Victoria, this is defined as ‘the sum of 98.60 plus 2.34 for every whole 1000 of the monetary consideration. Maximum fee is 3609.00’1.. For example: If a property costs $500,000 in Victoria, with no easements created or surrendered, the transfer fee payable would be $ 1269.00 (as on July 1st 2024).

Mortgage Brokers

Oh, that’s right! MoneyQuest broker’s services are at zero cost, moving on.

Mortgage Registration Fee

Mortgage registration fees are charged by state or territory governments to register the new property as security on your home loan. They’re usually around a couple of hundred dollars.

LMI

If you cannot cover the deposit value of a home, which is 20% of the property’s value, you may need to pay Lender’s Mortgage Insurance (LMI). Once again, first home buyers are generally exempt from this, so long as they can afford a 5% deposit. Property value, your finances, and the state or territory you live in are what decide how much LMI you pay. It Insures lenders against high-risk borrowers.

Property Inspection

Property Inspections inspect the building for any faults or damage, and address pest infestation. The combined cost for building and pest inspection usually costs around $400-$600.

Final Settlement

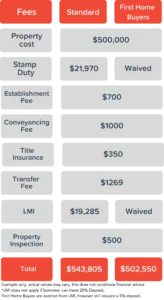

With all of these costs associated, let’s look at the accumulated price of buying a $500,00 home in Victoria.

As you can see, additional costs of buying a home do stack up and it’s integral when applying for a home that you have surplus finances outside of the actual property cost available. To get a better grip on your finances and develop a home-buying strategy, reach out to your local MoneyQuest broker today!

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2025 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823