Why Are Interest Rates Going Up and How High Will They Go?

Did you hear? On the 1st of November 2022, the Reserve Bank of Australia (RBA) increased the cash rate for the seventh consecutive month since April 2022. As of November 2022, the cash rate sits at 2.85%, with banks passing the rise on to homeowners. I’m sure many of you are asking yourselves, “but why?”.

Why is the RBA raising the cash rate?

The answer is quite simple. The RBA is raising the cash rate to curb inflation in the economy. Inflation occurs when the price of goods and services increase and one of the ways it can be tracked is by measuring the Consumer Price Index (CPI). As the cost-of-living rises, the value of money decreases, which negatively impacts purchasing power.

A small amount of inflation is generally considered healthy for an economy, however when inflation climbs higher than target rates, people may start demanding higher wages, forcing businesses to increase their input costs to cover higher wages. This may result in what’s known as a wage-price spiral, which can easily lead to even more inflation.

It’s important to understand there are many other contributing factors to inflation; we’ll explore these later in this blog.

So, to dampen the effects of inflation, the RBA usually increases the cash rate, which is then passed onto the banks. This is predominately why home loan interest rates increase.

Consequently, this makes the cost of borrowing money more expensive, driving people to tighten their spending on goods and services. This typically causes the economy to slow down, causing a reduction in inflation.

Now you can understand the balancing act central banks like the RBA must play, in order to help keep the economy steady.

Why is inflation increasing?

Now you understand what inflation is, and how it can impact the economy; let’s look at what’s causing inflation to rise. Below are some key contributing factors to our current economic climate.

The COVID-19 pandemic and supply shortages – Do you remember when it was hard to buy a roll of toilet paper? The pandemic was a strange time for us all… and the economy! At the start of the 2020 lockdowns, consumer spending habits quickly changed due to sudden lifestyle shifts. Demand of some goods and services fell dramatically (clothing, petrol, hospitality), while others rose sharply (food and non-alcoholic beverages, housing, electricity). This sudden shift in spending created uncertainty in the economy and supply shortages, which are still affecting us to this day.

The war in Ukraine causing energy and food price surges – While the conflict between Ukraine and Russia may not feel like it’s impacting Australians day to day, considering all the market disruptions from sanctions and supply chain breakdowns, it’s naive to assume we’re not affected.

Russia is the world’s second largest producer of gas, third largest producer of oil and a significant supplier of metals. The reduction in supply causes higher prices, impacting businesses and the entire economy.

Excessive money printing – We’ve explained the basics of inflation and how it can impact an economy. One of the primary objectives of central banks is stimulating the economy in a positive way to create positive growth. One of the ways they do this is through quantitative easing (QE). Simply put, QE is when a central bank buys government bonds and other assets to essentially ‘print’ money to inject into the economy.

But can printing money become a problem?

When you increase the total money supply in an economy, you’re essentially putting more purchasing power into the hands of everyday citizens and businesses; too much of this and all of a sudden spending increases, causing more demand. Economic output can’t keep up, leading to higher prices and inflation.

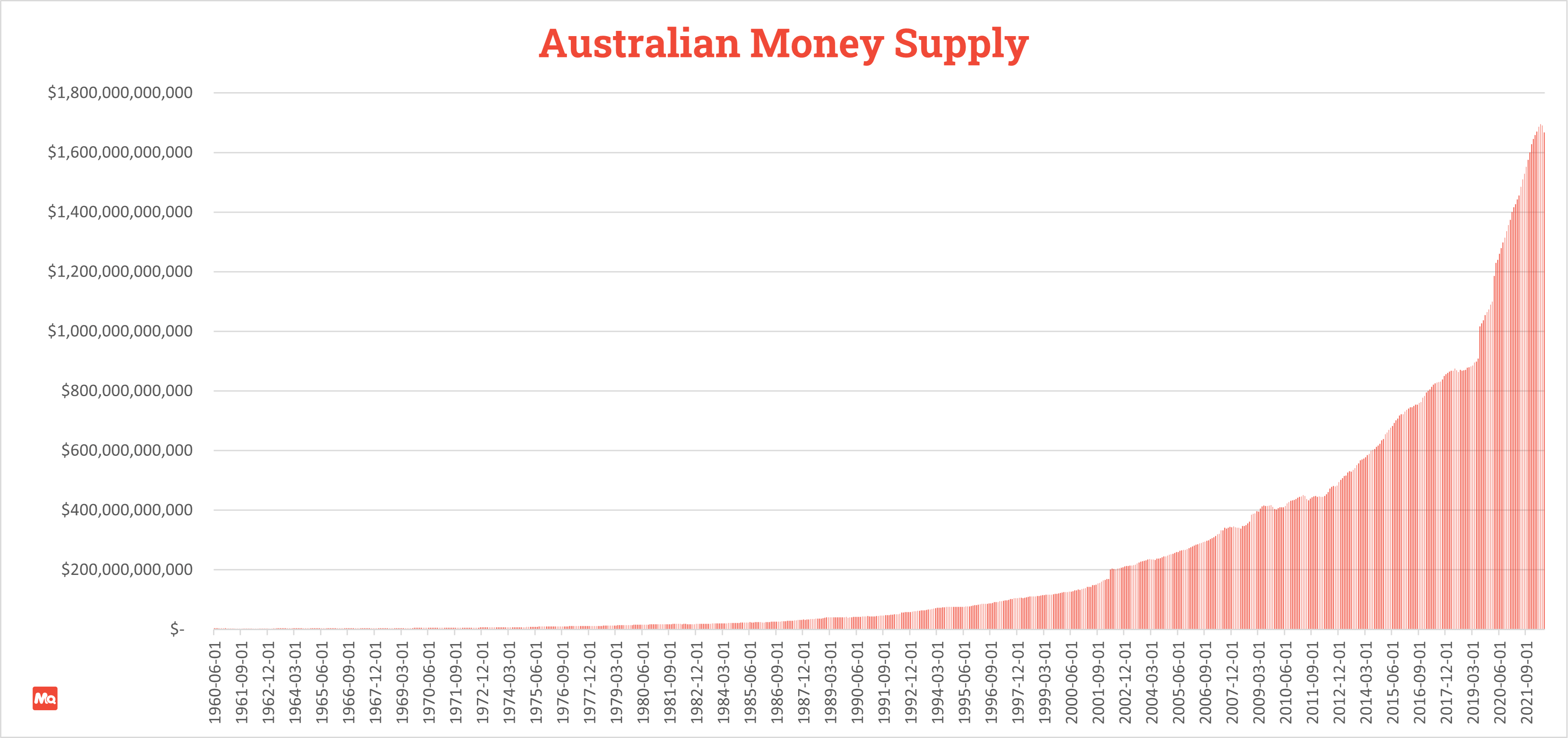

The chart below indicates the increase of Australian money supply. At the start of the global pandemic, there was a massive cash injection into the economy, inflating the total money supply. The RBA made this decision to prop up the economy at a time when people found it harder to access funds than it was pre-pandemic.

Combined with record-low interest rates up until April 2022, this may have been the catalyst that sparked rapid growth in inflation.

How high will interest rates go?

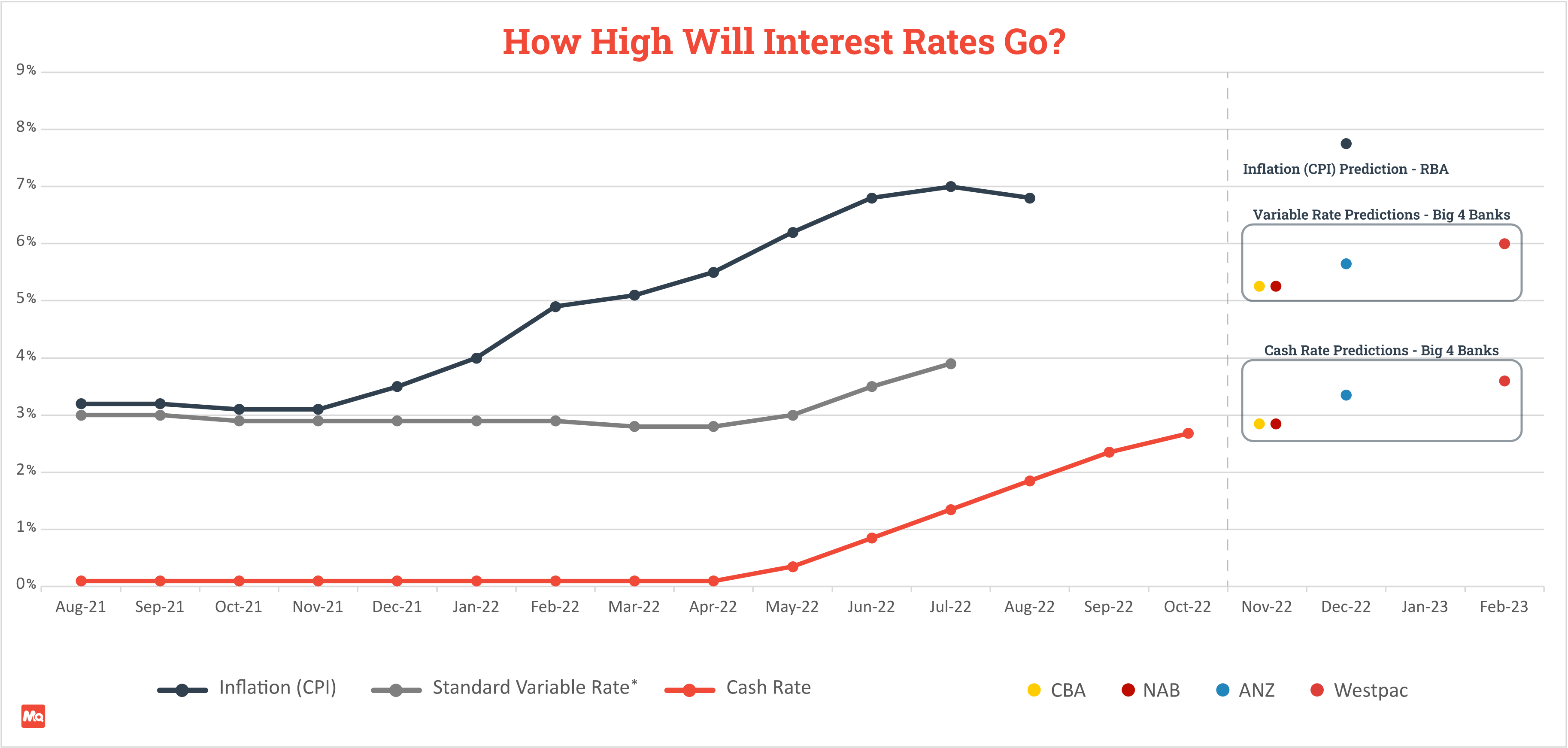

Nobody really knows exactly how high interest rates will rise in the short term, but we can always speculate – the banks certainly have! On the left side of the chart below is historical data for inflation (CPI), owner-occupier variable housing rates and cash rate. On the right is the cash rate, and variable rate predictions from the 4 big banks and the RBA inflation rate prediction.

*Owner-occupier variable housing rates, outstanding loans – RBA

The 4 big banks predict variable interest rates to peak between 5.29% – 6.04% around late 2022 and early 2023. This also puts their cash rate predictions to peak around 2.95% – 3.60% in the same period.

How will higher interest rates affect property prices and homeowners?

Now I know what you’re thinking; with everything mentioned above, the next 12 months or so could be a great time to purchase property, right? Well, we’ve written a separate article to help you answer that question – Should you buy property in Australia 2022-2023?

The short answer is nobody really knows; but we recommend you read the article in the link above to help you gain perspective, particularly if you’re thinking of buying property.

How will higher interest rates affect current mortgage holders? Let’s look at the good and the bad; let’s start with the good.

Household debt – According to the RBA, the majority of household debt is held by those in the top 40% of income distribution. Additionally, those with high debt-to-income ratios who are more likely to be affected by interest rate rises, are also likely to have higher incomes. This suggests a large number of households are likely to be able to handle somewhat higher interest rates.

However, some households will certainly face more financial hardship, especially first home buyers. If you’re a first home buyer thinking about entering the property market, read this article to understand government grants that may be available to you, helping you enter the market sooner.

Low incidences of negative equity – We all know property prices exploded during 2020-2021 and we’ve seen the household sector accumulate sizeable equity because of this.

According to the RBA, ‘negative equity was around 0.1% in May 2022, down from 2.25% prior to the pandemic’. Negative equity occurs when the amount borrowed on a property is larger than the value of the property. Since property prices have fallen slightly over the last few months, they would need to fall significantly for negative equity to become a systemic concern. This means the likelihood of borrowers defaulting on their home loan is slim.

Now, let’s look at how higher interest rates could negatively affect existing mortgage holders.

Very low fixed-rate mortgages soon to expire – It’s also important to consider mortgages on very low fixed-rates from 2020-2022 will soon expire, potentially causing significant mortgage stress to many households. According to the RBA, the majority of fixed-rate loans are due to expire in the second half of 2023. It’s unclear how the property market will respond during this time.

For those existing mortgage holders who may be worried about interest rises and whether they can meet their repayments, we have three pieces of advice to follow:

- Have a job and keep it.

- Job security is the best way to ensure you meet your repayments. At the moment, we’re also seeing record-low unemployment rates across the country; it’s an employee / candidate’s market and a good time to secure a job promotion, putting you in a better position to service a home loan.

- Find out ways you can reduce your cost of living.

- The team at MoneyQuest Australia have put their heads together to find 26 useful ways to reduce your cost of living and potentially save a whopping $5,866 a year! We’ve broken these tips into 5 basic categories. Click here to find out more.

- Speak with your local MoneyQuest broker

- We recommend all mortgage holders to reach out to a mortgage broker to find ways to improve your finances. At MoneyQuest, our finance specialists can help in a variety of ways and guide you during this unpredictable time, so if you want to chat about your loan, you know who to phone.

This article does not provide financial advice. Consider all options available to you, seek professional guidance and only choose an option you are comfortable with.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Proudly Part Of

The Money Quest Group (MQG) is one of Australia's leading boutique mortgage broking businesses, with a network of more than 600 brokers nationwide. Known for their exuberant culture and superior support, MQG provides brokers access to a range of financial products from more than 60 lending institutions and suppliers, and exclusive access to in-house benefits and services.

© 2017-2024 MoneyQuest Australia Pty Ltd, Australian Credit Licence 487823